As promised, Senate Minority Leader Mitch McConnell (R-KY) this week introduced legislation proposing to make the budget-busting 2001 and 2003 Bush tax cuts permanent. The so-called Tax Hike Prevention Act wouldn't merely drain $3.9 trillion from the U.S. Treasury over the next decade. At a time of record income inequality, the Republicans' $700 billion windfall for the wealthy would virtually ensure a perpetual income gap. Call it PIG for short.

As the Washington Post reported, the price tag for the Republican scheme is staggering. Among the highlights of the McConnell bill are preventing a return of upper bracket income tax and capital gains rates to their Clinton-era levels and cutting the estate tax even as the threshold is raised to $5 million per person. Oh, and red ink as far as the eye can see:

The nonpartisan Congressional Budget Office recently forecast that a similar, slightly more expensive package that includes a full repeal of the estate tax would force the nation to borrow an additional $3.9 trillion over the next decade and increase interest payments on the national debt by $950 billion. That's more than four times the projected deficit impact of President Obama's health-care overhaul and stimulus package combined.

And as the Post's Ezra Klein pointed out, unlike the health care law (which cuts the deficit) and stimulus spending (which is temporary), the Republican bill is forever:

There is no policy that President Obama has passed or proposed that added as much to the deficit as the Republican Party's $3.9 trillion extension of the Bush tax cuts...Republicans and tea party candidates are both running campaigns based around concern for the deficit. But both, to my knowledge, support the single-largest increase in the deficit that anyone of either party has proposed in memory.

But making matters worse - much worse - for working Americans is that the Republican plan would also make today's unprecedented income inequality a permanent fixture of the U.S. economy.

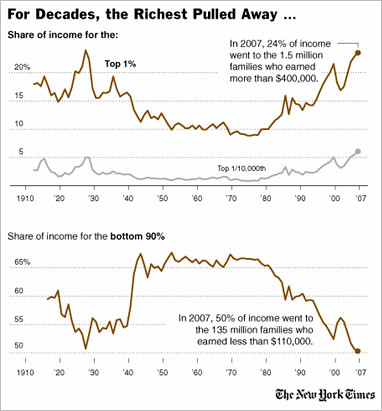

As the New York Times, the Center on Budget and Policy Priorities (CBPP) and a new report from the Democratic majority on the Congressional Joint Economic Committee all document, during the Bush years the income gap between the rich and everyone else reached levels not seen since 1929.

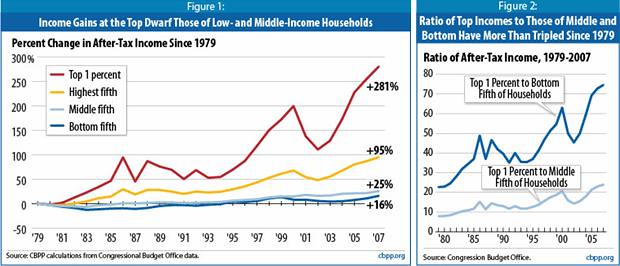

As the new JEC analysis concluded, "While the rich have gotten richer, middle class Americans have been left behind." The CBPP report found a financial Grand Canyon separating the very rich from everyone else. Over the three decades ending in 2007, the top 1 percent's share of the nation's total after-tax household income more than doubled, from 7.5 percent to 17.1 percent. During that time, the share of the middle 60% of Americans dropped from 51.1 percent to 43.5 percent; the bottom four-fifths declined from 58 percent to 48 percent. As for the poor, they fell further and further behind, with the lowest quintile's income share sliding to just 4.9%. Expressed in dollar terms, the income gap is staggering:

Between 1979 and 2007, average after-tax incomes for the top 1 percent rose by 281 percent after adjusting for inflation -- an increase in income of $973,100 per household -- compared to increases of 25 percent ($11,200 per household) for the middle fifth of households and 16 percent ($2,400 per household) for the bottom fifth.

To be sure, the deficit-exploding Bush tax cuts played an essential role in fueling the gap. (This is evidenced by the fact that between 2001 and 2007, the income share of the 400 richest American taxpayers doubled even as their tax rates were halved.) As the New York Times revealed in October, by 2007 the top 1% - the 1.5 million families earning more than $400,000 - reaped 24% of the nation's income. The bottom 90% - the 136 million families below $110,000 - accounted for just 50%.

And now, with their Perpetual Income Gap (PIG) Act, Republicans would make the two-tiered society and the end of the American dream permanent.

Last month, the nonpartisan Joint Committee on Taxation examined the impact of the Democratic proposal to let the Bush tax cuts of 2001 and 2003 lapse for just the top bracket households making over $250,000 year. "Taxpayers with income of more than $1 million for 2011 would still receive on average a tax cut of about $6,300 compared with what they would have paid under rates in effect until 2001", the New York Times reported, adding, "that compares, however, with the roughly $100,000 average tax cut that households with more than $1 million in income would receive under current rates." In words and pictures, The Washington Post explained the payday for the rich if the GOP gets its way:

New data from the nonpartisan Joint Committee on Taxation show that households earning more than $1 million a year would reap nearly $31 billion in tax breaks under the GOP plan in 2011, for an average tax cut per household of about $100,000.

(Click here to see full size chart.)

The price tag for Americans' largesse for the wealthiest who need it least? $36 billion in 2011 alone, and $700 billion over the next decade.

In July, the reliably Republican Wall Street Journal offered its own pretty picture of the contending Democratic and Republican tax proposals. Despite GOP mythmaking about a "$3.8 trillion tax increase" and the "ticking tax bomb," President Obama and his Democratic allies are offering middle class Americans greater tax relief at virtually income level:

But while the next gilded class giveaway can still be stopped, the vault-fattening the past nine years is already a done deal.

In February 2004, President Bush proclaimed, "we cut taxes, which basically meant people had more money in their pocket." Of course, some people are more equal than others.

But this latest GOP-sponsored pig-out for the rich is nothing new. As the data show, fighting - and winning - the class war on behalf of the wealthy is simply what Republicans do.

(This piece also appears at Perrspectives.)

No comments:

Post a Comment